“It will continue to transform financial services and drive prices down.” “Digital is phenomenal for customers,” said Michael Kent, CEO of money transfer startup Azimo. Overall, the influx of fintech firms offering money transfer services means consumers can probably get better deals than ever. The EU also has rules requiring payment providers to disclose this information in a neutral and comprehensible manner. In February, the UK’s Financial Conduct Authority published a policy statement (pdf) on payments, as authorities look to make these services more clear and to avoid misleading advertising claims. A spokesperson said at the time that the company made a page on its website to explain the the calculation in more detail.Įuropean regulators have looked into this issue. The watchdog said TransferWise had manipulated the data to its own advantage and hadn’t made enough comparative informative available to clients for them to make a judgement. TransferWise also got dinged in 2016 by the UK’s advertising regulator for what it said were misleading claims about how much customers can save on its platform. FXC data shows that the eight-year-old company doesn’t always offer the best deal. TransferWise is seen as transparent because, among other things, it shows the total cost of a transfer in the senders’ currency. We are transparent about the exact amount a customer pays and what the recipient receives so that our customers can make an informed decision.” “Our fees and rates are listed clearly for every transaction for our customers as you can see here,” the spokesperson said in an email. The most transparent is probably TransferWise.”Ī spokesperson for PayPal said Xoom’s rates for international transfers are competitive. “To be fair to PayPal and Xoom, they’re among the few that say they directly make money from the exchange rate,” Webber said. But the customer still has to go to another website to figure out the difference between Xoom’s offered rate and the actual market rate. Xoom, for example, discloses that it charges a transaction fee and also tells the customer that it makes money through the foreign-exchange rate it charges. The complex array of charges can be tricky to figure out for a person who isn’t familiar with foreign exchange rates, so looking simply at how much money the receiver will get is the easiest way to assess which service offers the best deal. This makes for thousands of different price combinations. It can also depend on the remittance corridor (the foreign-exchange pair and countries involved), the amount of the transfer, and floating currency rates that are constantly changing. There are a number of variables in play, such as cash versus bank-to-bank transfer, or debit versus credit card. That makes it important to shop around for the best rates. Nobody is the cheapest one over everything, or even the most expensive.” “We see this across the market generally.

“In some cases they are quite competitive, in others they are less competitive versus the market average,” said Daniel Webber, founder and CEO of FXC Intelligence.

XOOM CURRENCY RATES VERIFICATION

The transfer would take between 2 -3 days and you may need to provide additional verification for this amount.When everything is taken into account, PayPal’s Xoom is usually somewhere in the middle versus its competitors, according to FXC data.

XOOM CURRENCY RATES PLUS

For a debit or credit card, you would incur a fee of $601.49 plus the exchange rate markup.

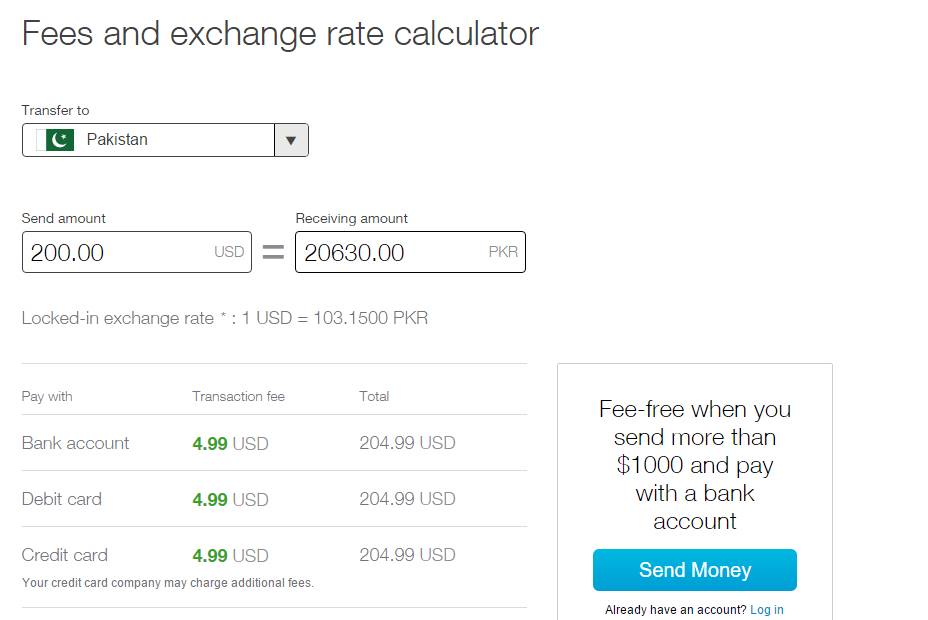

If you are sending money via debit or credit card, you should expect a fee of $30.49 plus the exchange rate markup Xoom adds.Īgain, Xoom charges no fees for bank transfer, but that’s not to say that you may incur expensive charges directly from your bank. Xoom’s fees actually go down for larger transactions if you are using a bank transfer (although you may incur additional fees from your bank, and the recipient may incur fees from their bank on the other end). Unfortunately, Xoom’s exchange rate margins are not clear, but you should expect to pay a markup between 2 – 3% on the mid-market rate. To send this amount to Spain, you should expect to pay a fee of $4.99 for a transfer via your bank account, or $6.49 using your debit or credit card.

0 kommentar(er)

0 kommentar(er)